You must do certain things to ensure a smooth adjustment of the employee’s wages. Before you change an employee’s wages, make sure you understand pay adjustments and how to make them. Making payroll adjustments for employees is an important part of running a business.

Once you know why and how much you’re adjusting, make sure you notify the employee’s managers and check for payroll compliance. After that, all you need to do is let your employee know about the adjustment and make the appropriate change in your payroll software. You can always check with a legal or HR expert before making a negative pay adjustment.

Payroll Adjustments: A Guide for Small Business Owners

A payroll adjustment software enables you to assign variables for a certain period of time, both on an individual basis and for each department. The employee’s wages must be at least the greatest of the federal, state, or local minimum wage. Staying on top of wage and hour and other 20 best seasonal photographer jobs employment-related laws is an important part of payroll compliance.

What is a pay adjustment?

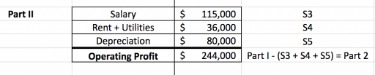

With Hourly, you can choose from standard payroll adjustments, like bonuses or reimbursements, or you can sales general and administrative vs cost of goods sold create a custom adjustment. Either way, Hourly software automatically calculates new deductions based on the adjustment, so you don’t have to worry about changing withholdings for taxes and benefits. A negative pay adjustment happens when you need to lower an employee’s regular pay. You may need to use a one-time negative adjustment to correct an overpayment mistake. A pay raise, for example, is a positive and permanent adjustment because you’re increasing your employee’s pay moving forward.

- In contrast, a year-end bonus is a one-time salary adjustment where you increase your employee’s pay for one period, and then it goes back to normal.

- It’s imperative to include retro pay on pay stubs, so that it’s evidenced in your employee records.

- A payroll overpayment is when an employer pays an employee more than the worker should have received in a pay period.

- Transparent policies help in managing employee expectations and reducing dissatisfaction.

Avoiding employee overpayment in the future

A pay adjustment is any changes to an employee’s pay, whether an increase or decrease, one-time or long-term. By following these steps, HR managers can implement pay adjustments that are fair, compliant with relevant laws, and beneficial for both the company and its employees. Cost-of-living adjustments are made to account for inflation and changes in the cost of living. These adjustments ensure that employees’ wages maintain their purchasing power over time.

To calculate gross retro pay, figure out the difference between what an employee was paid in a payroll marginal cost formula period and what they were owed (including any supplemental pay). If a pay raise or bonus isn’t calculated into a payroll period, then it’ll be owed retroactively by the employer. Set up the overpayment deductions like a post-tax deduction, not a pay decrease. This means that you’ll withhold the overpayment collection after withholding taxes from the employee’s pay. After you’ve checked your state laws and notified the employee, it’s time to adjust your future payroll(s) to recover the overpayment. Implementing a pay adjustment involves several crucial steps to ensure fairness and accuracy.

And, you must report each employee’s wages and tax withholdings on Form W-2. A payroll overpayment is when an employer pays an employee more than the worker should have received in a pay period. It’s helpful to give your team advanced notice about any pay adjustments, even if they are positive. You can tell employees in person, ask managers to notify them, or write an email with the details.

The FLSA sets the federal minimum wage, overtime pay, and other labor standards that employers must follow. When making pay adjustments, companies must ensure that employees are paid at least the federal minimum wage and receive appropriate overtime compensation. This includes considering any payroll adjustments that might affect these standards, such as changes in hours worked or pay rates for different shifts. Maintaining accurate records of pay adjustments is essential for legal compliance and transparency. Employers should document every payroll adjustment, including the reasons for the adjustment and the new pay rate.

Lascia un commento